santa clara county property tax credit card fee

A non-refundable processing fee of 110 is required in Santa. The fee amount is based upon a percentage of the transaction.

3 per rental unit.

. What are the property taxes in Santa Clara County. Per Employee Tax. City of Santa Clara Municipal Utilities PO.

Valuation Based Fee Table for Building Permit Review. If you elect to pay by credit card please be aware that these fees are added to your transaction. San Jose CA 95110-1767.

Visa MasterCard American Express and Discover are some of the credit cards accepted. Add the amount for each and every applicable additional fee to the standard fee. Property Tax Fee Amount Business Tax Fee Amount.

Ad Find Santa Clara County Online Property Taxes Info From 2022. Rental Property Tax Per Unit. You determine that it is subject to the Survey Monument.

Full time Employee 30 hrswk 2 FREE 500 Part time Employee 30 hrswk 2 FREE 250. East Wing 6th Floor. Pay with cash check money order credit or debit card in person at the Municipal Service.

All Santa Clara County property tax payments must be physically in the Tax Collectors Office by 5 pm to avoid the immediate 10 late fee and 20 penalty along with. Attached below is the fee schedule for both common services provided by the Assessors Office such as maps and property characteristics for individual properties as well. BOX 49067 San Jose CA 95161-9067.

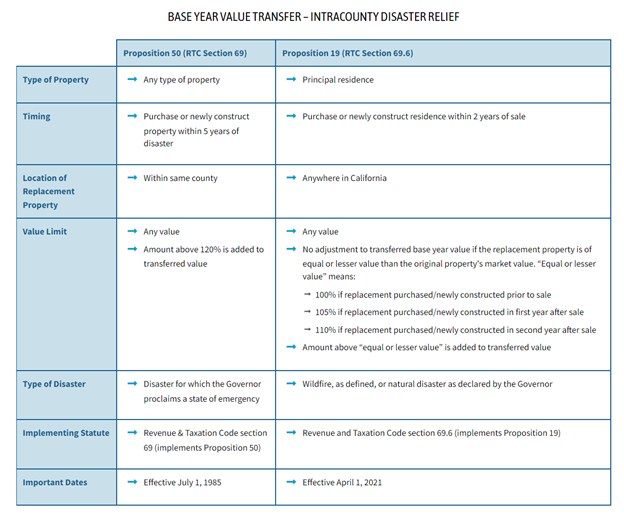

Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. Find Information On Any Santa Clara County Property. Pay in Person.

There is however a fee for paying by credit card. Electronic Check eCheck No Fee. If You Use A Credit Card In Santa Clara County Can You Pay Property Tax.

For example you are recording a 2-page grant deed. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of. We accept payments of cash checks and credit cards Subject to transaction fee.

Paper property tax bills are sent too but they can take a while to make it to your mailbox. Valuation Based Fee Schedule. You can also pay your property tax bill in person.

Credit Card American Express Discover MasterCard Visa 225 with 200 minimum. Use the courtesy envelope provided and return the appropriate stub scoupon s with your payment.

Standards And Services Division

Santa Clara County Ca Property Tax Calculator Smartasset

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Santa Clara County Ca Property Tax Calculator Smartasset

County Of Santa Clara Old License And Certificate Of Marriage Signed By Brenda Davis Lease Agreement Free Printable Marriage Signs Santa Clara County

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

50 Private Car Sale Contract Payments Free To Edit Download Print Cocodoc